Forex trading operates 24 hours a day, 5 days a week, creating a unique opportunity for traders to participate at nearly any time. However, not all trading sessions are created equal. Identifying the Best Forex Trading Times On Exness is critical for maximizing profitability and minimizing risk. This guide will help you navigate the best times to engage in forex trading on the Exness platform, how trading schedules vary, and in what ways you can optimize your trading strategy for maximum efficiency.

Why Timing Matters in Forex Trading

Forex is a global market spanning multiple time zones and trading hubs. The market is most active during overlapping trading sessions, where liquidity surges and price movements can be optimal for traders. Conversely, periods of low activity may result in increased spreads and reduced opportunities.

Key Highlights of Forex Trading Timing:

- Liquidity peaks during overlapping sessions, such as London-New York.

- Volatility varies by time, heavily influenced by news releases and specific trading hours.

- Spread widening often occurs during low-volume sessions, particularly during transition hours.

Understanding these dynamics is essential to identifying the best forex trading times on Exness, allowing traders to minimize costs and strategically approach market movements.

Exness Forex Market Hours: A Breakdown

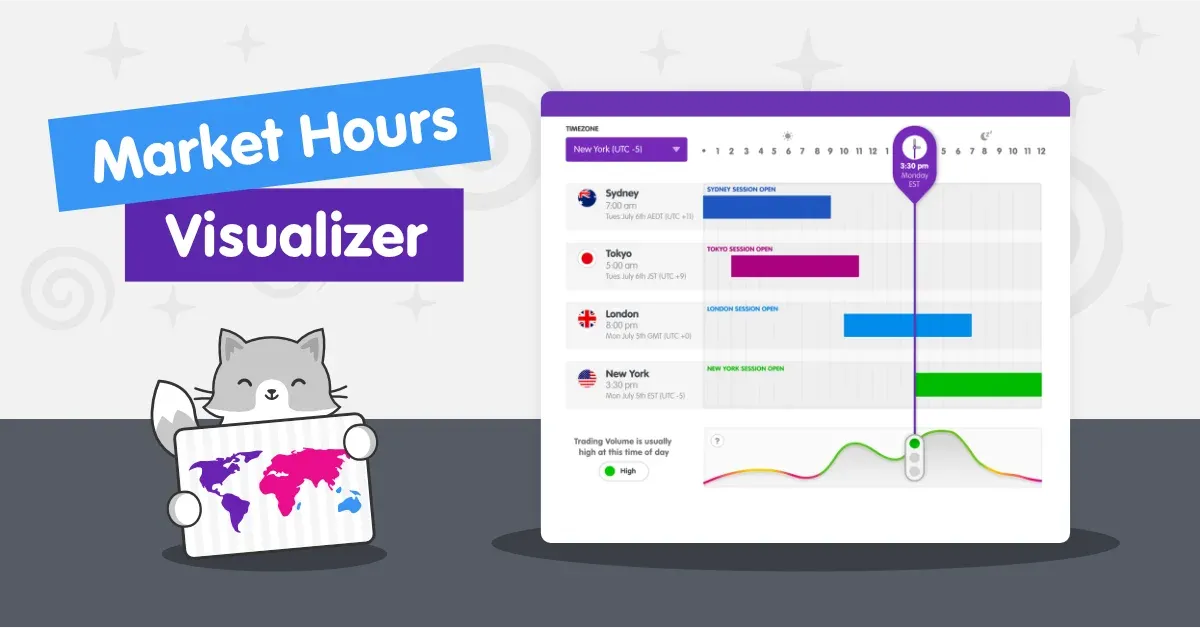

Forex trading on Exness follows the global trading sessions, including:

- Sydney: The market officially opens in Sydney, making it an excellent starting point for traders in the Asia-Pacific region.

- Tokyo: Activity picks up when Tokyo begins, often contributing to the Asian session’s major movements.

- London: The forex market hits its stride during the London session, which offers substantial trading opportunities.

- New York: As New York opens, the market reaches its liquidity peak, especially during the overlap with London.

Here is a comparative table showing the session timings across key trading zones:

| Trading Session | Opens (GMT) | Closes (GMT) | Best Pairs to Trade |

|---|---|---|---|

| Sydney | 10:00 PM | 7:00 AM | AUD/USD, NZD/USD |

| Tokyo | 12:00 AM | 9:00 AM | USD/JPY, EUR/JPY |

| London | 8:00 AM | 5:00 PM | EUR/USD, GBP/USD |

| New York | 1:00 PM | 10:00 PM | USD/JPY, USD/CAD |

Pro Tip: Traders should focus on the overlap between London and New York sessions (1:00 PM to 5:00 PM GMT) for the highest liquidity and volatility.

To better understand the nuances of these trading sessions, refer to the detailed Exness Forex Market Hours Guide.

Identifying the Best Times for Forex Trading on Exness

The Optimal Trading Hours

The best trading times depend on the following factors:

- Market Overlaps: During overlaps like London-New York, traders benefit from robust liquidity and tighter spreads.

- Volatility Windows: Currency pairs tied to specific regions often see higher volatility during their respective sessions (e.g., AUD/USD during Sydney).

Avoid Low-Liquidity Periods

Periods such as the transition between the New York close and Sydney open, also known as the “dead zone”, often experience low liquidity and wider spreads. These conditions can diminish profitability and make execution more challenging.

Optimal trading schedule for Exness forex trading

Optimal trading schedule for Exness forex trading

Impact of Holidays and Economic Events

Holidays differ between regions, often influencing liquidity. For instance:

- New Year’s Day and Christmas result in market closures across most sessions.

- Regional holidays (e.g., Golden Week in Japan) typically lower activity for specific currency pairs.

Economic events such as non-farm payroll releases or central bank decisions also significantly impact market movements. Utilizing tools like the Exness Economic Calendar helps traders anticipate key opportunities.

For traders seeking to time trade entries effectively, the Timing Trades with Exness Market Watch guide offers valuable insights.

Tips to Optimize Forex Trading on Exness

-

Concentrate on Active Pairs:

- Trade major pairs during their dominant session.

- Focus on GBP/USD or EUR/USD during the London and New York sessions.

-

Monitor News Events:

- Look for high-impact economic events. Exness’s integrated news feed is invaluable for staying updated. Exness News Feed for Market Timing offers insights into global trends.

-

Utilize Exness Trading Tools:

- Use features like Exness’s Market Watch and Leverage calculators for accurate decision-making. For an understanding of leverage timing, check out the When to Apply Exness Leverage article.

-

Practice Flexible Trading Strategies:

- Backtest strategies during different sessions on a demo account before implementing in live trades. Learn more at When to Practice with Exness Demo.

Expert Insight: Master Your Trading Schedule

“Timing is everything in forex trading. By aligning with the market’s most liquid hours, traders gain a decisive edge. Layering this with tools like economic calendars and real-time market analysis ensures a winning strategy.”

— Mark Bennett, Forex Strategy Expert with 12+ years of experience.

Conclusion

To truly succeed in forex trading, understanding the best forex trading times on Exness plays a pivotal role. By operating within active trading windows, leveraging the Exness platform’s tools, and avoiding low-liquidity periods, traders can optimize their efforts for maximum gains.

Remember, consistency, preparation, and adaptability align the odds in your favor. Start exploring your potential today and make strategic timing your ally in forex trading success.

FAQs

1. What is the best time to trade forex on Exness?

The best time is during session overlaps, particularly the London-New York overlap (1:00 PM to 5:00 PM GMT), due to increased liquidity and tighter spreads.

2. Which currency pairs are most active during the London session?

The most active pairs include EUR/USD, GBP/USD, and cross pairs like EUR/GBP.

3. How do holidays affect Exness trading hours?

Holidays can cause thin liquidity, wider spreads, and market closures. Check the Exness calendar for specific holiday schedules.

4. Is it better to trade forex during high or low volatility?

The choice depends on your trading strategy, but high volatility during active sessions often presents more opportunities.

5. What tools does Exness provide for timing trades?

Exness offers tools like Market Watch, an Economic Calendar, and integrated news updates to help traders time their positions accurately.

6. Can I trade during weekends on Exness?

Forex trading on Exness is unavailable over weekends as the global forex market is closed. However, crypto trading remains open.