The forex market operates 24 hours a day, making it one of the most accessible and dynamic financial markets globally. However, not every hour is equally ideal for trading. Understanding Exness Forex Market Hours is crucial for maximizing your trading potential. This guide provides a comprehensive overview of trading sessions, their timings in different time zones, and key strategies to help make the most of the market.

Why Forex Trading Hours Matter

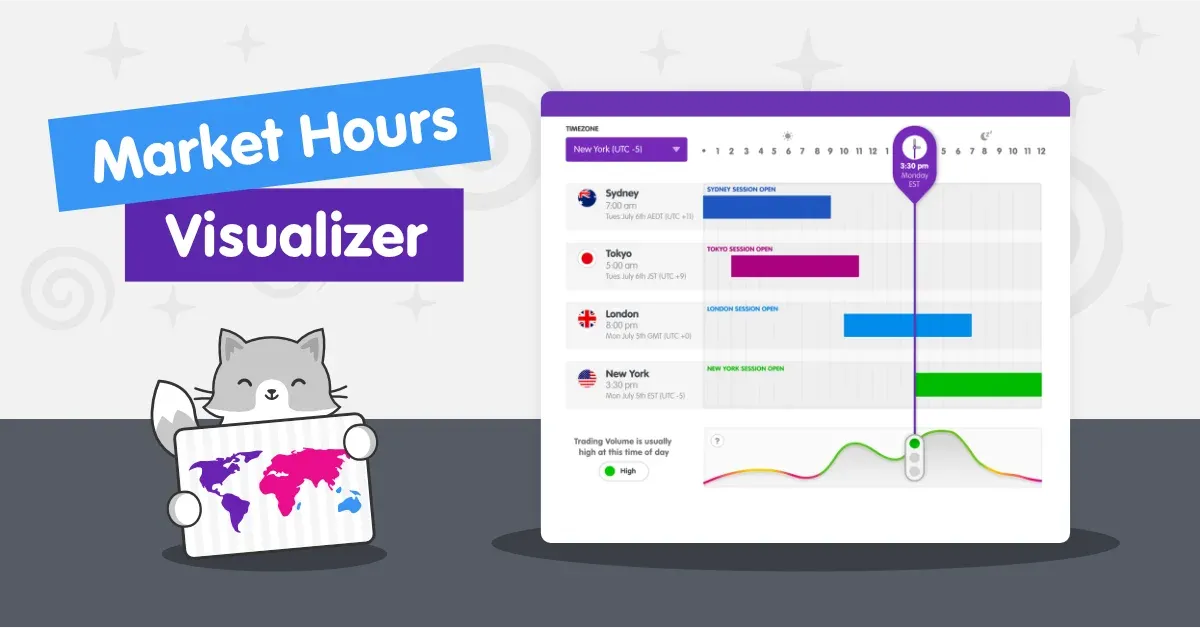

Forex is decentralized, operating through four major trading hubs—London, New York, Tokyo, and Sydney. Each of these sessions represents unique opportunities for traders. Knowing when these sessions overlap and how time zones affect market activity can determine your trading success.

“Timing is everything in forex trading. The better you understand market hours, the greater your chances of executing profitable trades.” – John Carter, Forex Strategy Specialist

Key benefits of mastering forex market hours include:

- Identifying High Liquidity Periods: Certain hours see a surge in market activity due to overlapping sessions.

- Avoiding Low Volatility: Some periods, such as the end of trading days, are known for reduced market activity.

- Aligning Trading Strategies: Different market sessions favor different strategies, such as scalping, day trading, or swing trading.

Forex Market Session Overview

The Four Major Forex Market Sessions

Forex revolves around four primary sessions. Below are the details, along with their respective active hours:

| Session | Open (GMT) | Close (GMT) | Key Characteristics |

|---|---|---|---|

| Sydney | 10:00 PM | 07:00 AM | Slow market activity; focus on AUD and NZD pairs. |

| Tokyo | 12:00 AM | 09:00 AM | Strong activity in JPY pairs. |

| London | 08:00 AM | 05:00 PM | Highly liquid session, major movements in EUR and GBP pairs. |

| New York | 01:00 PM | 10:00 PM | USD pair fluctuations and end-of-day volatility. |

Note: Timings may vary during daylight saving periods.

Session Overlaps: Prime Trading Opportunities

When two sessions overlap, trading volume and volatility peak, creating favorable opportunities:

- London–New York Overlap (1:00 PM to 5:00 PM GMT): This is the most volatile period, driven by economic news releases from both Europe and the United States.

- Sydney–Tokyo Overlap (12:00 AM to 7:00 AM GMT): Ideal for trading AUD and JPY pairs.

Impact of Time Zones and Holidays

Forex is a global market, and time zones have a profound impact. Traders should also be aware of public holidays in major economies, which can result in reduced liquidity.

For example:

- U.S. holidays such as Independence Day significantly affect the New York session.

- National holidays in Japan impact trading volumes during the Tokyo session.

Utilizing tools like the Exness Economic Calendar can help you keep track of holidays and significant economic events.

Best Times to Trade Forex with Exness

The Golden Hours

For traders on the Exness platform, optimal trading times vary based on your strategy:

- Scalpers: Focus on the London–New York overlap when spreads are tighter and liquidity is at its peak.

- Day Traders: The opening hours of the London session offer clarity as markets digest overnight news.

- Swing Traders: Use quieter periods, like the Asian session, to set up positions.

Avoiding Pitfalls with Off-Peak Trading

Non-overlapping hours generally see thinner liquidity, leading to:

- Wider spreads.

- Slower market reactions.

- Limited profit opportunities.

For beginners, it’s best to avoid trading during these times to prevent unnecessary losses.

Best hours for forex trading by market session

Best hours for forex trading by market session

Useful Tools for Planning Your Trading Schedule

Here are some must-use tools for traders on Exness:

- Exness Economic Calendar: Stay updated on global economic events.

- Market Time Converters: Adjust trading hours to your local timezone effortlessly.

- Real-Time Spreads on Exness: Monitor spreads to identify cost-effective trading opportunities.

Real-World Tips for Managing Your Trading Schedule

Here are actionable tips to optimize your trading schedule:

-

Know Your Time Zone

Convert market hours into your local time and set reminders for session overlaps. -

Incorporate Economic Events

Sync your trading approach with scheduled news releases. For instance, U.S. Non-Farm Payroll data often leads to price spikes in USD pairs. -

Start Small (For Beginners)

Focus on a single session and gradually expand your activity. -

Track Trading Performance

Evaluate whether specific market hours align with your profitability. Use Exness trading data to refine your approach.

“Consistency is key. Develop a trading schedule aligned with your personal availability and market dynamics to thrive in forex.” – Sarah Harper, Senior Forex Analyst

Frequently Asked Questions (FAQs)

1. What are the best Forex trading hours on Exness?

The London–New York overlap (1:00 PM to 5:00 PM GMT) is the most optimal time due to high liquidity and volatility.

2. How does daylight saving affect forex trading?

Daylight saving changes impact trading hours for London and New York. Always confirm session timings during these periods.

3. Should I trade during low-liquidity hours?

It’s generally not advisable, especially for beginners, as spreads widen and price movements become unpredictable.

4. How can I manage trading during holidays?

Use the Exness Economic Calendar to monitor global holidays and adjust your schedule accordingly.

5. Why are session overlaps important?

During overlaps, market participants from major sessions increase trading volume, leading to better liquidity and tighter spreads.

Conclusion

Mastering your trading schedule is fundamental to maximizing profits in forex. The Exness Forex Market Hours Guide not only helps you understand session timings but also empowers you to identify and act on prime trading opportunities. Whether you’re a beginner or a seasoned trader, aligning your strategy with market hours is a big step toward long-term success.

Take advantage of tools like the Exness Economic Calendar to stay ahead in the game. Remember, trading is a journey, and timing is your strongest ally.