Effective trading begins with understanding the financial markets, and one of the crucial tools for traders is market analysis. With Exness, analyzing markets becomes more accessible, providing insights into trends and strategies tailored for success. This article explores how “Reading Exness Market Analysis” can sharpen your trading approach and elevate your financial outcomes.

What is Market Analysis, and Why Is It Important?

Market analysis is the systematic assessment of market conditions using historical data, charts, and real-time updates. It empowers traders to make informed decisions, ensuring fewer risks and optimized strategies.

Types of Market Analysis

When reading Exness market analysis, you’ll encounter three primary types:

-

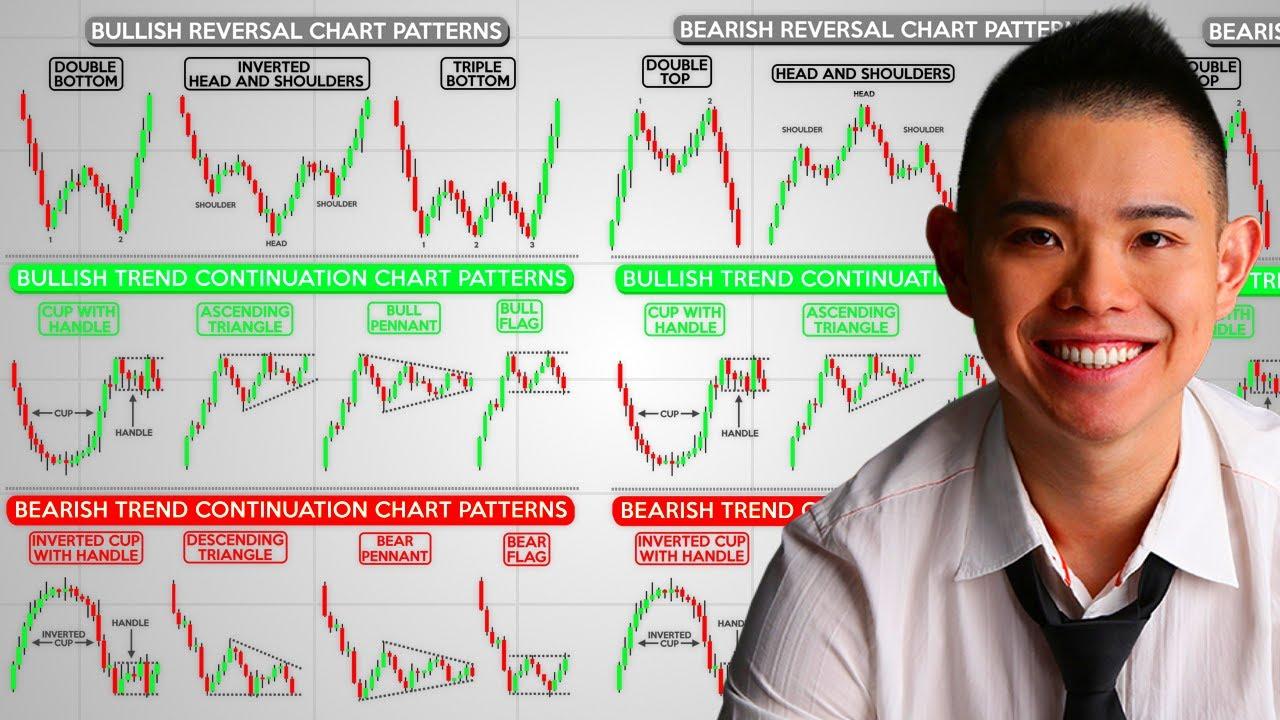

Technical Analysis:

- Focuses on price patterns, chart movements, and statistical indicators.

- Ideal for predicting short-term trends.

-

Fundamental Analysis:

- Examines macroeconomic factors, corporate reports, and global events.

- Suited for long-term strategy creation.

-

Sentiment Analysis:

- Gauges market psychology by interpreting trading behaviors and news impacts.

- Useful for understanding speculative activities.

Understanding these types allows traders to blend approaches for maximum efficiency.

How Exness Market Analysis Enhances Decision-Making

Exness offers clear, actionable, and concise market analysis tailored for traders at every level. Here’s what makes it indispensable:

Real-Time Insights

Stay ahead with up-to-date analysis covering global financial events. Whether it’s forex, commodities, or stocks, Exness ensures you never miss critical trends.

Expert Content

Exness market analysis incorporates expert opinions, helping traders align their strategies with professional perspectives. John Carter, a professional analyst at Exness, emphasizes:

“Successful trading isn’t just about intuition; it’s about leveraging accurate and timely insights to stay ahead of volatility.”

User-Friendly Format

Complex data is distilled into digestible segments, from technical charts to simplified explanations.

Steps to Read Exness Market Analysis

Understanding how to navigate the analysis is key to optimizing its benefits. Follow these simple steps:

-

Login to Your Exness Account:

Access the analysis section directly from the user dashboard. -

Choose Your Asset:

Select forex pairs, commodities, or stock indices based on your trading preferences. -

Interpret Key Data Points:

- Charts: Look for trends, support/resistance levels, and candlestick patterns.

- News Feed: Factor in headlines influencing market sentiment.

- Indicators: Explore RSI, MACD, and moving averages for technical analysis.

-

Combine Types of Analysis:

Blend technical, fundamental, and sentiment insights for a holistic approach. -

Apply Findings to Trading Strategy:

Utilize the conclusions to enter or exit trades with confidence.

An Exness trading platform showcasing technical analysis tools, including RSI and MACD indicators

An Exness trading platform showcasing technical analysis tools, including RSI and MACD indicators

Benefits of Reading Exness Market Analysis

Traders gain various advantages when utilizing Exness’s market analysis:

- Minimized Risks: Early identification of potential pitfalls.

- Enhanced Precision: Better timing for entering and exiting trades.

- Confidence Boost: Reliable data fosters certainty in decision-making.

As Sarah Nguyen, a seasoned forex expert, states:

“Exness market analysis keeps me informed and sharp, ensuring I have the confidence to trade in volatile conditions.”

Common Mistakes to Avoid When Reading Market Analysis

While Exness streamlines the process, mistakes can still happen. Be mindful of:

- Ignoring Fundamentals: Never overlook broader economic factors.

- Over-Reliance on Indicators: Balance quantitative data with qualitative insights.

- Selective Reading: Consistently review all parts of the analysis.

To ensure success, approach market analysis holistically.

Example of common mistakes in market analysis interpretation on Exness platform

Example of common mistakes in market analysis interpretation on Exness platform

Conclusion

Reading Exness market analysis is a potent tool for traders aiming to optimize their financial strategies and achieve consistent success. By leveraging real-time updates, expert opinions, and actionable data, traders like you can navigate the complexities of financial markets confidently. Start today, and ensure your trading decisions are informed, precise, and profitable.

FAQ

1. What is Exness market analysis?

Exness market analysis provides insights into market trends, forecasts, and strategies to help traders make informed decisions.

2. Who can use Exness market analysis?

It’s tailored for both beginner and advanced traders seeking to optimize their performance.

3. Does Exness market analysis cover all trading instruments?

Yes, Exness analyzes forex, stocks, indices, and commodities comprehensively.

4. How often is the analysis updated?

Exness market analysis offers real-time updates, ensuring traders are always informed.

5. Is Exness market analysis suitable for long-term trading?

Definitely. By combining fundamental and technical analysis, it supports both short-term and long-term strategies.

6. How do I integrate Exness market analysis into my strategy?

Follow the analysis steps: interpret data, combine methodologies, and apply insights to your trading plan.

7. Are beginners able to quickly understand Exness analysis tools?

Yes, Exness provides user-friendly formats designed for accessibility, even for novice traders.