Effective risk management is the cornerstone of successful trading, and one of the most pivotal tools for this is a stop loss order. On the Exness platform, setting a stop loss is essential for safeguarding your trading capital and ensuring emotional discipline. In this guide, we’ll explore the process, advantages, and best practices for using stop loss orders to elevate your trading strategy.

What is a Stop Loss Order?

A stop loss order is a pre-set instruction given to your broker to automatically close a trade once an asset reaches a specific price level. Its primary purpose is to limit potential losses and protect your investments from market volatility.

Key Points to Remember:

- Risk Limitation: Stop loss orders cap your losses at a predetermined level.

- Automated Execution: Once triggered, the trade is closed without further action required.

- Versatility: Useful for all asset types, from forex to commodities.

By understanding how to effectively set a stop loss on Exness, you can actively manage risk while staying focused on your long-term trading goals.

Why is Setting a Stop Loss Important?

Stop loss orders are more than just a protective measure—they are a critical part of a disciplined trading strategy. Here’s why:

- Minimizes Emotional Trading: By setting predefined exit points, you avoid impulsive decisions driven by fear or greed.

- Preserves Trading Capital: It ensures you don’t lose more than you’re willing to risk on a single trade.

- Enhances Consistency: Adhering to stop loss levels maintains the integrity of your trading plan.

Giang Tran, a senior trading analyst, says:

“A committed approach to setting stop loss orders bridges the gap between hope-driven buying and strategic, structured trading.”

How to Set a Stop Loss on Exness: A Step-by-Step Guide

Follow these straightforward steps to configure stop loss orders within Exness:

1. Log into Your Exness Account

Begin by logging into your Exness Personal Area. Ensure your account is verified and funded. For insights into using your dashboard effectively, refer to Navigating Exness Personal Area.

2. Open a New Trade

- Navigate to the trading terminal and select the asset you wish to trade.

- Choose the volume of your trade, taking position sizing into account.

3. Define Your Stop Loss Level

While setting up your trade, locate the stop loss (S/L) input box in the order window. Enter the price level at which the stop loss will be triggered.

Tips for Choosing Stop Loss Levels:

- Align stop loss levels with price action or key support/resistance zones.

- Use the Average True Range (ATR) indicator to determine volatility-based stop loss settings.

4. Confirm and Monitor the Trade

Once configured, double-check your inputs to ensure accuracy before confirming the order. Keep monitoring your trades periodically, but rest assured the stop loss feature operates automatically.

Types of Stop Loss Strategies to Use on Exness

Not all stop losses are created equal. Consider implementing one of these popular strategies:

1. Fixed Stop Loss

Set a static price level based on your ability to bear losses.

Pros: Simple and consistent for new traders.

Cons: May lack flexibility with volatile markets.

2. Trailing Stop Loss

This dynamic stop loss “trails” the asset’s price as it moves in your favor, locking in profits while limiting downside risk.

Pros: Maximizes gains; protects capital during trends.

Cons: May trigger prematurely in choppy markets.

3. Time-Based Stop Loss

Set a stop loss that activates if a trade doesn’t meet certain conditions within a specified timeframe.

Pros: Prevents tying up capital unnecessarily.

Cons: Requires advanced planning and monitoring.

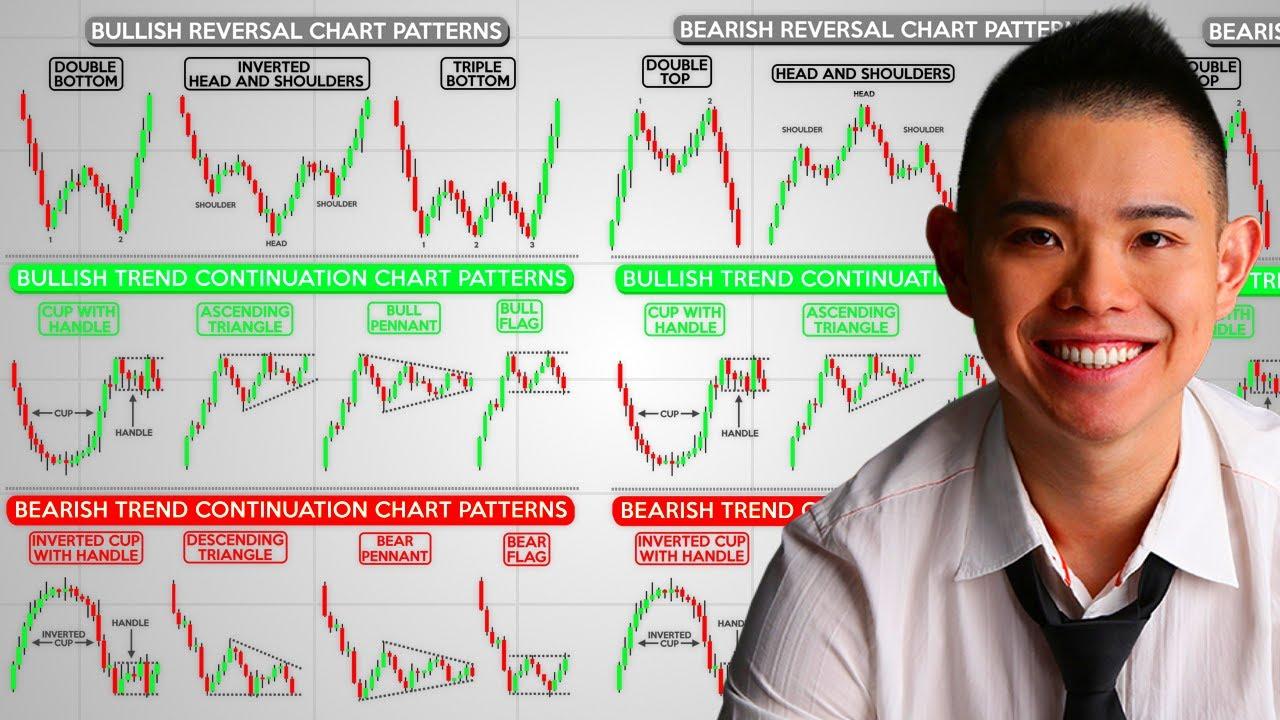

Illustration of a candlestick chart with recommended stop-loss placement based on market trends

Illustration of a candlestick chart with recommended stop-loss placement based on market trends

Common Mistakes to Avoid When Using Stop Loss Orders

Here are some pitfalls that traders often encounter:

- Placing the Stop Loss Too Close: Tight margins increase the likelihood of getting stopped out due to minor market fluctuations.

- Ignoring Trading Costs: Incorporate spread and slippage into your calculations for realistic execution.

- Over-Reliance: Stop losses should complement, not replace, comprehensive trading strategies.

Le Van Quang, an experienced forex instructor, emphasizes:

“Stop loss orders are a shield, not a silver bullet. When paired with sound analysis, they become a trader’s best resilience tool.”

Advanced Tips for Optimizing Stop Loss Management

To further enhance your risk management:

- Position Sizing Matters: Only risk 1-2% of your account balance per trade.

- Backtest Your Strategy: Use historical data to simulate how your stop loss levels would perform under varying conditions.

- Adapt Based on Market Conditions: Adjust stop losses to accommodate high-volatility events such as news releases.

Detailed infographic showcasing stop-loss strategies tailored for Exness traders

Detailed infographic showcasing stop-loss strategies tailored for Exness traders

Conclusion

Setting a stop loss on Exness enhances your ability to trade smarter, not harder. It creates a safety net for your trading capital while allowing you to focus on executing winning strategies. Whether you’re a seasoned investor or a novice, adopting stop loss methods ensures you remain in control of your trades—even in volatile markets.

By understanding the nuances of stop loss tools, you position yourself for long-term success while mitigating risks effectively. To dive deeper into navigating the Exness platform, explore articles like Navigating Exness Personal Area.

Frequently Asked Questions (FAQs)

1. What’s the Minimum Stop Loss Distance Allowed on Exness?

Exness typically requires stop loss levels to be placed a certain number of pips away from the market price. This varies depending on the asset and account type.

2. Can I Adjust My Stop Loss After Placing a Trade?

Yes, you can modify stop loss levels via the terminal. Simply right-click the trade and select “Modify or Delete Order.”

3. What is a Trailing Stop on Exness?

A trailing stop automatically adjusts your stop loss level when the market moves in your favor, securing profits while limiting losses.

4. Can Stop Loss Prevent Negative Account Balances?

While stop losses limit losses per trade, they cannot guarantee absolute protection during extreme market conditions. Exness, however, offers negative balance protection.

5. How Do I Calculate the Ideal Stop Loss Size?

Use tools like position size calculators or the ATR indicator to determine an optimal level based on market volatility.

6. Why Did My Trade Close Before Hitting the Stop Loss?

This may occur due to slippage, especially during high-volatility events. Always account for this possibility when setting stop loss levels.

By implementing these insights, trading on Exness becomes a more structured and confident endeavor.