Understanding the right trading times is a critical element for any trader seeking success in the global financial markets. With Exness Market Watch, traders gain insights into the optimal trading hours, market activity patterns, and potential profit opportunities. This guide delves into what makes trading schedules pivotal, offering actionable strategies to elevate your trading game by timing trades effectively.

Why Does Trading Schedule Matter?

The trading schedule plays a vital role in market activity by determining liquidity, volatility, and price trends. Each financial market operates within specific timeframes, influenced by global time zones and key trading sessions, such as the New York, London, Tokyo, and Sydney markets. Lack of awareness of these trading windows can lead to missed opportunities or inefficient trades.

Key Components of a Trading Schedule:

- Market Overlap: The highest trading volume often occurs during overlapping market sessions (e.g., London and New York).

- Timing for Specific Instruments: Different assets, such as forex, stocks, or commodities, have unique peak trading times.

- Impact of News Releases: Economic events align with certain time zones, significantly increasing volatility.

“Traders who fail to align their strategies with market schedules often encounter challenges in capturing optimal entry and exit points,” says Anne Johnson, a financial analyst with over a decade of experience.

Understanding Exness Market Watch: A Trader’s Compass

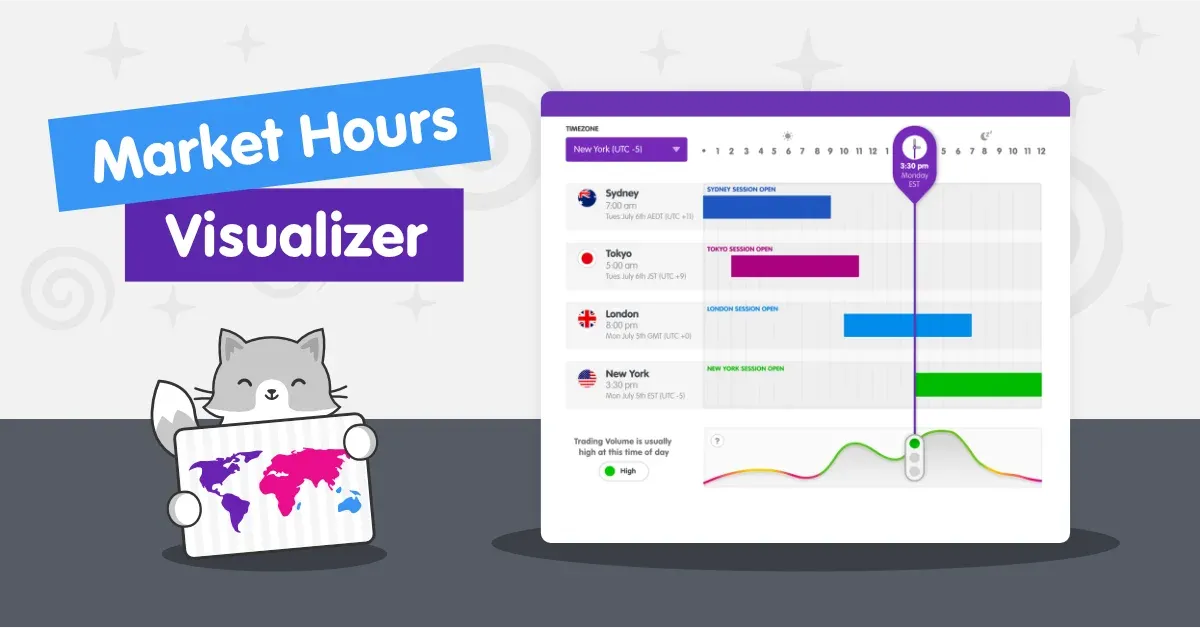

Exness Market Watch is a powerful feature that keeps traders informed about global market timings, assisting them in maximizing their efficiency and profitability. Below are some features and benefits:

1. Major Trading Sessions and Timings

Financial markets operate across four primary sessions. Knowing when these markets are most active can boost your trade outcomes.

| Market Session | Open (GMT) | Close (GMT) | Key Features |

|---|---|---|---|

| Sydney | 22:00 | 06:00 | Moderate volatility in forex pairs like AUD/USD |

| Tokyo | 00:00 | 09:00 | Best for JPY and cross-pair trading |

| London | 08:00 | 16:00 | High liquidity, favorable for all major forex pairs |

| New York | 13:00 | 21:00 | Crucial session for USD-based pairs and commodities |

Major trading sessions in global forex markets

Major trading sessions in global forex markets

2. Market Overlaps: The Golden Hours

Market overlaps are periods when two major sessions run simultaneously, creating higher liquidity and tighter spreads. The London-New York overlap (13:00 – 16:00 GMT) is widely regarded as the most profitable window due to intense trading activity.

- Tip: Reserve your high-volume trades for market overlaps to leverage significant price movements.

3. Customizable Features with Exness Market Watch

Exness Market Watch can be tailored to cater to individual preferences. Users can set up notifications for session openings, track specific instruments during peak hours, and even visualize busy trading windows.

“With Exness Market Watch, traders are no longer guessing the right time to trade. It provides them the clarity to make informed decisions,” notes Matt Carter, a veteran forex trader.

Optimizing Your Trades with Time-Sensitive Strategies

Timing is everything in trading. Below are some actionable strategies to align your trading hours with market dynamics:

1. Trade When the Market is Most Active

Trading during high-volatility periods ensures increased opportunities for gains. Market overlaps (e.g., Tokyo-London or London-New York) are ideal for exploiting price movements.

2. Adapt to Your Preferred Asset Class

- Forex traders should capitalize on activity during major currency pair sessions.

- Stock indices like NASDAQ or DAX thrive during their home markets.

- Commodity traders can take note of oil or gold volatility peaks during overlapping sessions.

3. Stay Updated on Economic Calendars

Tools like Exness Market Watch provide access to economic news calendars. Use this to anticipate potential price swings during major announcements, such as interest rate decisions or employment data.

Example: Non-Farm Payroll (NFP) data, released during the New York session, typically causes notable volatility.

Forex news events impacting global trading sessions

Forex news events impacting global trading sessions

4. Mimic Smart Traders

Analyze historical trade data from high-performing traders to identify recurring patterns linked to specific trading schedules.

The Role of Time Zones and Public Holidays

Global time zones can create complexities for traders. To minimize disruptions:

- Synchronize your local schedule with UTC/GMT, which serves as the universal standard in trading.

- Adjust your strategy for market closures during international public holidays, such as New Year’s Day or Christmas.

Let’s not forget, market liquidity can drop significantly during holiday periods, increasing the chances of erratic price movements.

Key Takeaways on Timing Trades

Understanding and leveraging trading schedules is essential for profitability. With tools like Exness Market Watch, traders get to:

- Identify the best times to trade based on their asset class.

- Stay ahead of the market with timely alerts and session analysis.

- Navigate complex schedules involving time zones and public holidays.

“A smart trader is not someone who trades more but someone who trades better by embracing informed timing strategies,” suggests Sarah Lee, an experienced market strategist.

Frequently Asked Questions

1. What is Exness Market Watch?

Exness Market Watch is a tool designed to help traders optimize their schedules by tracking global market times, sessions, and economic news.

2. What are the golden hours in trading?

The golden hours refer to the market overlaps, such as London-New York (13:00-16:00 GMT), providing the most liquidity and volatility.

3. How do I trade during public holidays?

Be cautious during holidays as liquidity often drops. Avoid trading unclear trends, and use Exness tools to assess market conditions.

4. Why are certain trading sessions more volatile?

Different regions dominate specific sessions due to economic activity. For instance, the US dollar plays a significant role during the New York session.

5. How does Exness Market Watch help beginner traders?

It simplifies trading decisions by providing access to session timings, overlaps, and economic events—perfect for those still learning to manage their schedules.

By mastering the art of Timing Trades With Exness Market Watch, you equip yourself with a powerful strategy to stay ahead of the markets. Remember, success in trading isn’t about luck—it’s about trading smarter.