The world of financial trading revolves around precise timing, and understanding the best moments to act can significantly impact your success. One of the most powerful tools for traders is the Exness Economic Calendar, which provides critical insights into global economic events and helps traders make informed decisions. In this article, we’ll explore how to use this calendar effectively, optimize your trading schedule, and stay ahead in the ever-changing financial markets.

What Is the Exness Economic Calendar?

The Exness Economic Calendar is a comprehensive tool designed to keep traders updated on the dates and times of crucial economic events across the globe. These events, such as interest rate announcements, GDP reports, or employment data releases, often lead to significant market volatility. By tracking them, traders can identify opportunities and risks, and adjust their strategies accordingly.

Key Features of the Exness Economic Calendar:

- Real-time Updates: Ensure you never miss critical events.

- Global Coverage: Provides information from major economies worldwide.

- Categorized Event Impact: Classifies events by their level of potential market impact (low, medium, high).

- Customizable Filters: Allows personalization based on currency, magnitude of impact, and event type.

- Time Zone Adjustments: Tailors schedules to match local time zones for convenience.

Using this tool strategically is essential for creating a robust trading schedule that aligns with market movements and reduces unnecessary risks.

Why Timing Matters in Trading

When it comes to trading, especially in forex or other volatile markets, timing can mean the difference between profit and loss. Markets tend to react strongly to economic data, often creating price fluctuations that traders can capitalize on. For instance, a central bank’s decision to raise interest rates might strengthen a currency, while weaker-than-expected employment numbers might weaken it.

“The ability to anticipate market reactions to news releases is a game-changer,” explains Michael Sanders, a seasoned trader and forex analyst. “By leveraging tools like the Exness Economic Calendar, traders can approach markets with confidence and clarity.”

Benefits of Aligning Your Trading Schedule with Economic Events:

- Enhanced Market Awareness: Stay updated on crucial events.

- Mitigated Risks: Avoid trading during unpredictable market conditions caused by high-impact events.

- Improved Strategy Execution: Capitalize on predictable patterns before, during, and after economic releases.

How to Use the Exness Economic Calendar Effectively

Harnessing the full potential of the Exness Economic Calendar requires a precise approach. Below, we provide a detailed guide on leveraging this tool:

1. Familiarize Yourself with Event Types

The calendar includes a multitude of economic events, such as:

- Interest Rate Decisions: Influences currency demand.

- Inflation Data: Signals purchasing power and monetary tightening potential.

- Employment Reports: Drives trends in economic health.

- GDP Announcements: Measures growth performance.

- Trade Balances: Indicates export-import strength.

Each event type has a varying degree of impact on different currencies and asset classes.

2. Set Up Filters to Match Your Preferences

Adjust the calendar’s filters to ensure you’re only viewing relevant data. Tips for customizing filters:

- Select Currencies: Focus on the currencies you trade most frequently.

- Choose Impact Level: High-impact events often have the largest influence on the market.

- Select Date Ranges: Narrow results to specific days or weeks for focused planning.

3. Analyze Event Details and Forecasts

Every calendar entry includes detailed information:

- Actual Results: Released data, updated in real-time.

- Forecasts: Market expectations for the event.

- Previous Data: Historical results for reference.

For instance, if an upcoming GDP report for the U.S. shows a forecast of 2.8% growth but markets expect a lower result, it’s likely to cause volatility in USD pairs.

👤 “Preparation is key,” emphasizes Anna Reynolds, a forex coach and risk management specialist. “Evaluate the forecasted data against past trends to decide whether to enter, hold, or exit positions on the events.”

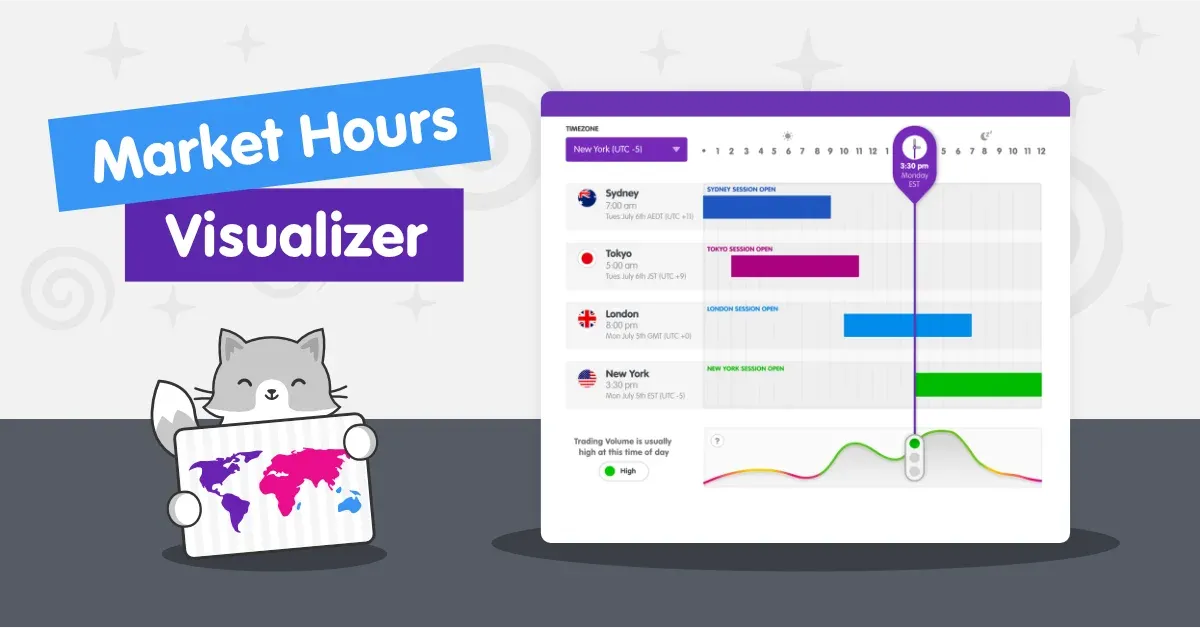

4. Plan Trades Around Key Market Hours

Economic events often coincide with periods of high market activity. Here’s a quick overview of market hours:

| Market | Opening Hours (GMT) | Peak Activity |

|---|---|---|

| Sydney (AUD) | 22:00 – 07:00 | Overlap with Tokyo |

| Tokyo (JPY) | 00:00 – 09:00 | During U.S. session prep |

| London (GBP/EUR) | 08:00 – 17:00 | Overlap with NY session |

| New York (USD) | 13:00 – 22:00 | Overlap with London |

Utilizing the Exness Economic Calendar to map key events alongside these overlaps helps you maximize liquidity and minimize slippage.

5. Create a Risk Management Strategy

Volatile periods around significant news events can amplify gains but also increase risks. To navigate safely:

- Use Stop-Loss Orders to limit losses.

- Monitor event outcomes closely for unexpected results.

- Avoid trading highly leveraged positions during high-impact events.

6. Check Historical Trends

Reviewing how markets responded in the past provides critical insights. The calendar’s historical data feature can be invaluable for planning future trades.

Economic Calendar Overview with Key Features

Economic Calendar Overview with Key Features

How the Exness Economic Calendar Helps You Stay Competitive

The Exness Economic Calendar isn’t just about tracking dates; it’s about empowering traders to:

- Stay informed amid constantly changing global economic dynamics.

- Simplify decision-making by offering actionable insights.

- Gain confidence by aligning strategies with major financial events.

Real-Life Example: GBP/USD Trade Based on BoE Interest Rates

Imagine trading GBP/USD on the day the Bank of England (BoE) announces its interest rate decision:

- Scenario A: BoE raises rates unexpectedly → GBP rallies sharply.

- Scenario B: Rates stay unchanged → Market consolidates or adjusts.

Checking the calendar in advance allows you to predict such scenarios, prepare for volatility, and set appropriate stop-loss/take-profit levels.

Conclusion

The Exness Economic Calendar is a critical resource for every trader, offering a structured foundation to manage trading activities effectively. By mastering this tool, you can anticipate critical market movements, reduce exposure to unnecessary risks, and fine-tune your trading schedule for optimal performance. Don’t just react to the markets—plan, act decisively, and thrive.

Are you ready to take your trading strategy to the next level? Start using the Exness Economic Calendar today and experience the power of well-informed decision-making!

Frequently Asked Questions (FAQs)

1. What is the best way to use the Exness Economic Calendar?

The best way is to align your trading schedule with high-impact events, customize filters for currency or region focus, and analyze actual data versus forecasts for strategic planning.

2. How often should I check the calendar?

To avoid missing critical updates, check the calendar daily or set specific alerts for events that matter most to your strategy.

3. Can the calendar help me avoid risks during volatile periods?

Yes, with the calendar highlighting high-impact events, you can consciously avoid trading during erratic market conditions or prepare risk strategies ahead of time.

4. Is the Exness Economic Calendar suitable for beginners?

Absolutely. The tool’s user-friendly interface and customizable features make it accessible to traders of all experience levels.

5. Does this calendar cover holidays affecting trading schedules?

Yes, it includes major public holidays worldwide, helping traders plan for reduced liquidity and volume in the markets.

6. What time zone is the calendar based on?

The Exness Economic Calendar allows time zone adjustments, so you can view events based on your local time for convenience.