Navigating the financial markets without the right tools can be a daunting challenge. This is where the strategic use of indicators on Exness—the robust trading platform—comes into play. Indicators not only offer insights into price trends but also help traders make informed decisions. This article will delve into how to use Exness indicators strategically, providing a comprehensive guide to optimizing your trading approach.

What Are Exness Indicators?

Exness indicators are technical tools designed to analyze market movements, identify patterns, and anticipate potential price changes. These indicators are built into the Exness trading platform and cater to traders of all levels. They are especially helpful for determining optimal trade entry and exit points, evaluating momentum, and tracking trends over time.

Types of Exness Indicators

There are four primary categories of indicators on the Exness platform:

-

Trend Indicators

Tools like Moving Averages and Bollinger Bands fall under this category. They are used to recognize and follow price trends over time. -

Momentum Indicators

These include RSI (Relative Strength Index) and Stochastic Oscillator, which measure the speed of price changes to identify overbought or oversold conditions. -

Volatility Indicators

Examples include the Average True Range (ATR) and Bollinger Bands, which focus on the range of price movement and market volatility. -

Volume Indicators

Tools like the On-Balance Volume (OBV) measure the trading volume to confirm market trends or predict reversals.

By understanding these categories, traders can better match indicators with their trading strategies.

Why Using Exness Indicators Strategically Matters

Using indicators strategically goes beyond simply plotting them on a chart. It involves knowing when, where, and how to use these tools to meet your trading objectives. Here are some reasons why a strategic approach is essential:

- Improved Decision-Making: Indicators provide objective data to support your trading plans.

- Risk Mitigation: They help identify entry/exit points and areas of potential market reversal, reducing the risk of incurring losses.

- Trend Identification: Recognizing ongoing trends allows traders to align their strategies for higher success rates.

“Indicators should serve as a compass for traders, guiding their decisions without overshadowing critical market research,” advises John Edwards, a financial analyst with over a decade of experience in technical trading.

Step-By-Step Guide to Using Exness Indicators Strategically

Strategic use of Exness indicators involves more than just understanding their functions. Below is a step-by-step guide to make the most of these technical tools:

1. Define Your Trading Style

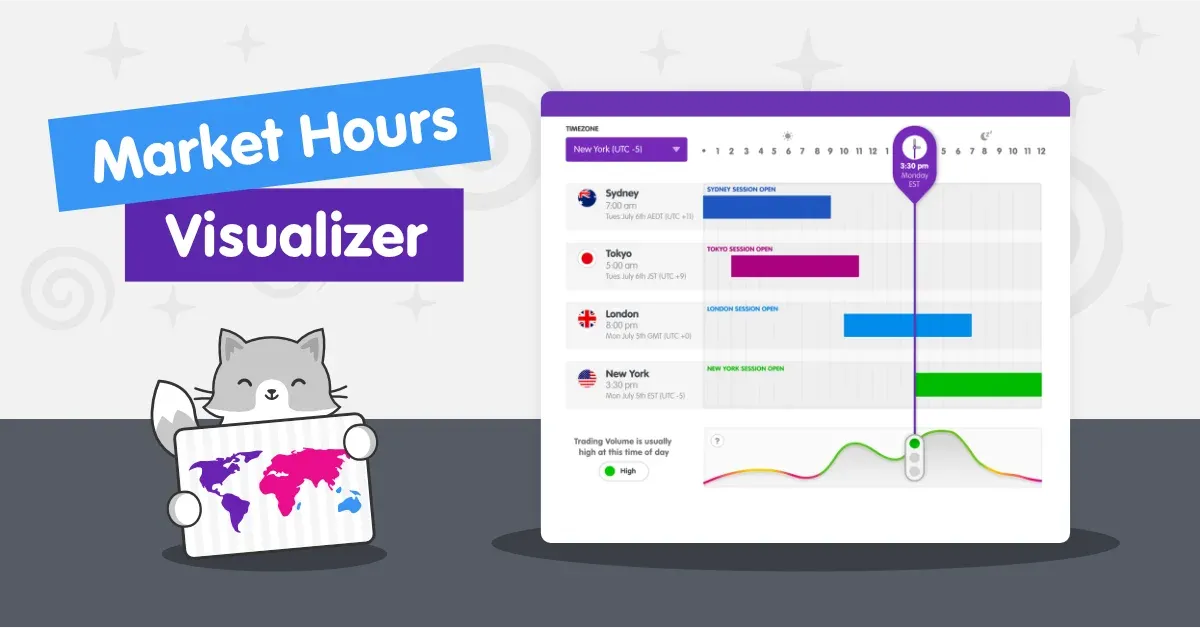

Before selecting indicators, determine your trading goals—day trading, swing trading, or long-term investing. For example, day traders may prioritize momentum indicators, while trend indicators might be more useful for swing traders.

2. Choose the Right Combination

Avoid overloading your charts with too many indicators. Instead, select complementary tools:

- Combine a Trend Indicator (e.g., Moving Average) with a Momentum Indicator (e.g., RSI) to identify both the market trend and price strength.

3. Analyze Multiple Timeframes

View charts across different timeframes to confirm trading signals. A signal observed on a 1-hour chart gains more reliability when supported by patterns on a 4-hour or daily chart.

4. Interpret Entry and Exit Points

Focus on indicator-specific signals:

- Use RSI values under 30 to identify buying opportunities.

- Watch for Moving Average crossovers to determine trend shifts.

5. Test Your Strategy (Backtesting)

Before applying indicators in live trading, test them against historical market data. This will help assess the effectiveness of your chosen strategy in varying market conditions.

6. Adjust Based on Market Dynamics

Markets are constantly evolving, so revisit and adapt your indicator usage periodically to match current conditions.

Example Table: Key Indicator Combinations for Different Strategies

| Strategy | Indicator 1 | Indicator 2 | Purpose |

|---|---|---|---|

| Swing Trading | Moving Average (MA) | RSI | Identify trends and potential reversals. |

| Day Trading | Bollinger Bands | MACD | Analyze volatility and market momentum. |

| Risk-Averse Trading | ATR | Stochastic Oscillator | Confirm market stability and signal strength. |

Exness indicators strategy example highlighting moving averages and RSI for better decision-making

Exness indicators strategy example highlighting moving averages and RSI for better decision-making

Common Mistakes When Using Indicators

Despite their usefulness, improper use of indicators can lead to costly errors. Avoid these pitfalls:

- Overcomplicating charts with too many tools.

- Ignoring market fundamentals while solely relying on indicators.

- Using the same strategy in all market conditions without adjustments.

- Overtrading based on minor signals instead of waiting for confirmations.

“Indicators work best when paired with thorough market analysis and a disciplined mindset,” says Linda Harper, a seasoned financial coach specializing in retail trading psychology.

How Exness Enhances Indicator Usage

Exness offers advanced tools that enhance the application of indicators:

- Customizable Settings: Tailor indicator parameters to align with your specific trading style.

- User-Friendly Interface: Easily overlay indicators and compare them on charts.

- Educational Resources: Access tutorials and materials to deepen your understanding of indicator mechanics.

Conclusion

Using Exness Indicators Strategically can significantly improve your trading success. By defining your goals, selecting appropriate tools, and adapting to market dynamics, you can transform how you approach financial trading. Remember, indicators are valuable components of a broader trading toolkit—when used wisely, they offer clarity and an edge in a volatile market.

Start exploring the power of Exness indicators today, and watch your trading journey take on a new level of precision and understanding.

Frequently Asked Questions (FAQ)

1. What are the best indicators for beginners on Exness?

For beginners, simple indicators like Moving Averages and RSI are great starting points. They are easy to interpret and provide actionable insights into market trends and strength.

2. Can I use multiple indicators at the same time?

Yes, but it’s crucial to avoid cluttering your chart. Combine complementary indicators, such as a trend and momentum tool, for better analysis.

3. How can I test if my indicator-based strategy is effective?

The best way to test your strategy is through backtesting. This involves applying your chosen indicators to historical price data and analyzing the results over time.

4. Are indicators always accurate in predicting market moves?

No, indicators are not foolproof. They serve as guidance tools and should be used alongside other analysis methods, such as fundamental analysis and market research.

5. Does Exness offer support for customizing indicators?

Yes, Exness allows users to customize indicator parameters to suit specific trading styles. Utilize these features for a more personalized approach.

Exness customizable indicator settings for tailored trading strategies

Exness customizable indicator settings for tailored trading strategies

6. Can indicators work in all market conditions?

Indicators are less effective in choppy or sideways markets. Understanding market phases is key to leveraging the right tools for each scenario.

By applying the practices and tips outlined above, traders can make more informed decisions and navigate the markets with confidence.