Transitioning from a demo account to a live trading account is a critical step for any trader. It requires careful consideration of factors such as trading confidence, consistency in results, and emotional readiness. This guide will help you understand when the right time to make this transition is, while providing valuable insights into optimizing your trading schedule and honing your trading skills.

Understanding the Purpose of a Demo Account

Before discussing the transition, it’s essential to understand why demo accounts exist. They are designed to:

- Allow traders to familiarize themselves with trading platforms.

- Test trading strategies risk-free using virtual funds.

- Build trading discipline without the emotional toll of live trading.

A demo account is not just a playground but a preparation ground for the complexities of live markets.

Key Signs You’re Ready to Go Live

Knowing when to switch from a demo account involves recognizing these signs:

1. Consistent Profitability in Demo Trading

If you’ve developed a trading plan and can consistently generate profits in a demo account for at least three to six months, it’s a good indicator that your strategy is robust. Keep in mind that consistent performance is more important than occasional wins.

Quick Tip:

Track your trading results over time and ensure your risk-reward ratio is favorable.

2. Emotional Control and Discipline

Trading live comes with heightened emotions due to real money being at stake. Emotional control is critical to avoid impulsive decisions.

“Mastering your emotions while managing losses is a cornerstone of successful trading.” – Sarah Turner, Senior Financial Analyst.

If you’ve been able to stick to your trading plan in the demo environment without overtrading or revenge trading, this is a positive sign.

3. Proficiency in Managing Risk

Risk management is key to surviving in the live market. If you’re comfortable applying stop-loss orders, calculating position sizes, and managing leverage, this indicates you’re prepared to protect your capital.

Checklist for Risk Management:

- Use stop-loss and take-profit orders effectively.

- Set a maximum percentage of your account you’re willing to risk per trade (typically 1%-2%).

- Avoid overleveraging.

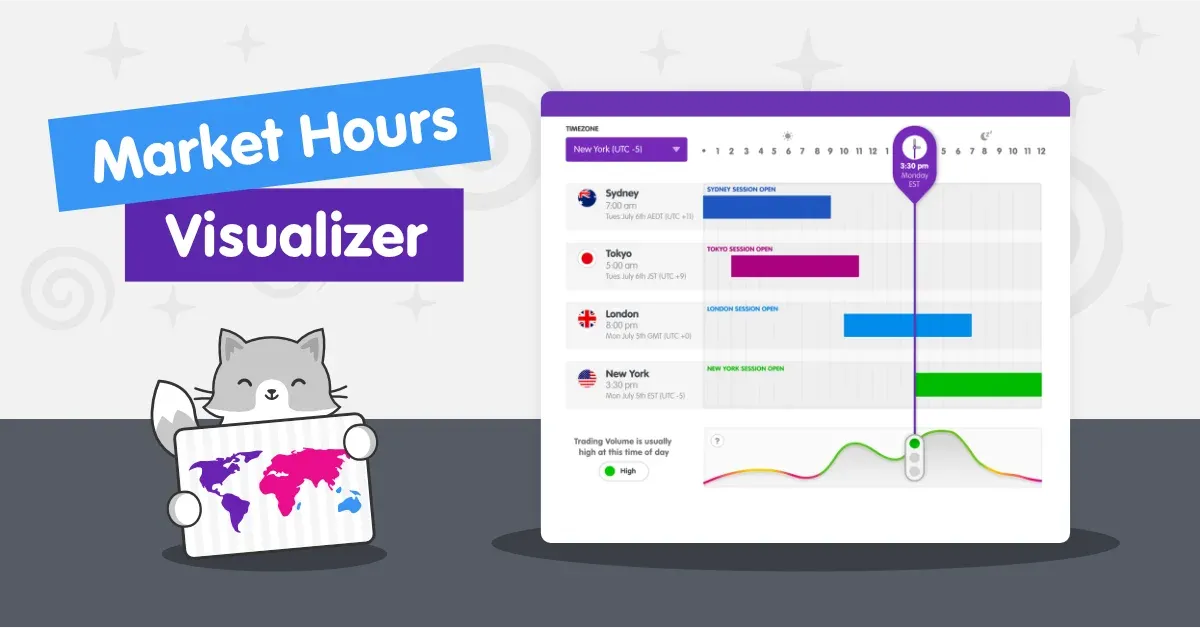

4. Familiarity with Trading Schedules

Understanding global trading schedules is vital for timing your trades effectively. Here are some key sessions to consider:

| Trading Session | Open Time (UTC) | Close Time (UTC) | Key Characteristics |

|---|---|---|---|

| Sydney (Pacific) | 10:00 PM | 7:00 AM | Low volatility, pairs like AUD and NZD are most active. |

| Tokyo (Asian) | 12:00 AM | 9:00 AM | Active session for JPY pairs; good for scalping and breakout strategies. |

| London (European) | 8:00 AM | 5:00 PM | High volatility; ideal for trading EUR, GBP, and cross pairs. |

| New York (American) | 1:00 PM | 10:00 PM | USD pairs dominate liquidity; overlaps with London session boost trade volumes. |

Optimize Your Trading Schedule:

Focus on trading during overlaps between major sessions (e.g., London and New York) to take advantage of higher liquidity and tighter spreads.

World’s major trading sessions listed in a table by time zones

World’s major trading sessions listed in a table by time zones

5. Understanding Costs and Fees

Live trading involves real costs, such as spreads, commissions, and swap fees. Familiarize yourself with these and ensure they align with your trading strategy. Take note of Exness’ competitive spread offerings for different account types.

6. Preparedness to Start Small

Transitioning to live trading doesn’t mean investing large sums immediately. Starting with a micro account or low initial deposit allows you to:

- Test your emotional resilience with real money.

- Adjust to the live trading environment without jeopardizing significant capital.

“Think of your first live account as a continuation of your learning process, not a shortcut to instant success.” – Richard Blake, Trading Coach.

Steps to Transition from Demo to Live

Step 1: Final Demo Testing

Refine your strategy in the demo account. Experiment with various market conditions and economic events to identify potential weaknesses.

Step 2: Open a Live Account with Minimal Capital

Choose an account type that suits your needs. Exness, for example, offers Standard Cent accounts for beginners, enabling you to trade with cent lots.

Step 3: Stick to Your Trading Plan

Treat your live account exactly like your demo account. This includes adhering to your risk management rules and avoiding rash decisions.

Step 4: Analyze Your Performance Regularly

Conduct weekly and monthly reviews of your trades, just as you would in your demo account. Adjust your strategy only if necessary, and avoid making decisions based on short-term results.

Step 5: Scale Gradually

Only increase your trading capital when you’ve consistently achieved success with your initial deposit.

Mistakes to Avoid When Transitioning

- Overconfidence: Demo success doesn’t guarantee live success. Emotional differences are significant.

- Skipping Risk Management: Never trade without stop-losses and predefined risk limits.

- Trading Without a Plan: Entering trades on impulse rather than a strategy is a recipe for disaster.

Conclusion

Transitioning to live trading is an exciting milestone in a trader’s journey but requires careful preparation. Focus on achieving consistent results, mastering emotional control, and understanding trading schedules before taking the leap. The key is to treat live trading as a progression of your practice, not an entirely new venture.

Embrace the process, remain patient, and remember—the market rewards discipline and preparation.

FAQs

1. How long should I practice with a demo account before going live?

Typically, three to six months of consistent profitability is recommended before transitioning to a live account.

2. How much money should I start live trading with?

Begin with a small amount, such as $100-$500, or use a cent account to minimize risk while learning.

3. Can I use the same strategy in live trading as in a demo account?

Yes, provided your strategy has been thoroughly tested and includes robust risk management techniques.

4. Why are trading schedules important in live trading?

Market volatility and liquidity vary across sessions. Trading during active periods helps you benefit from tighter spreads and more opportunities.

5. How can I control my emotions while trading live?

Start with minimal capital, follow your trading plan, and use techniques such as journaling and mindfulness to manage stress.

6. What mistakes should new live traders avoid?

Common mistakes include overleveraging, abandoning a trading plan, and trading based on emotions rather than analysis.