The journey to mastering financial markets starts with understanding when to practice effectively, especially using tools like the Exness Demo account. This article dives deep into the significance of timing in trading, offering insights on how to make the most out of your demo trading experience, while aligning with global trading schedules.

What Is the Best Time to Trade on an Exness Demo Account?

Trading is all about timing. Whether you’re a beginner or experienced trader, understanding when to practice on a demo account can massively influence your learning curve. Unlike real accounts where emotions like fear and greed dominate your decisions, a demo account offers a stress-free environment to simulate real market conditions.

To utilize the Exness Demo account effectively, focus on these key time windows:

1. Overlap Periods Between Major Markets

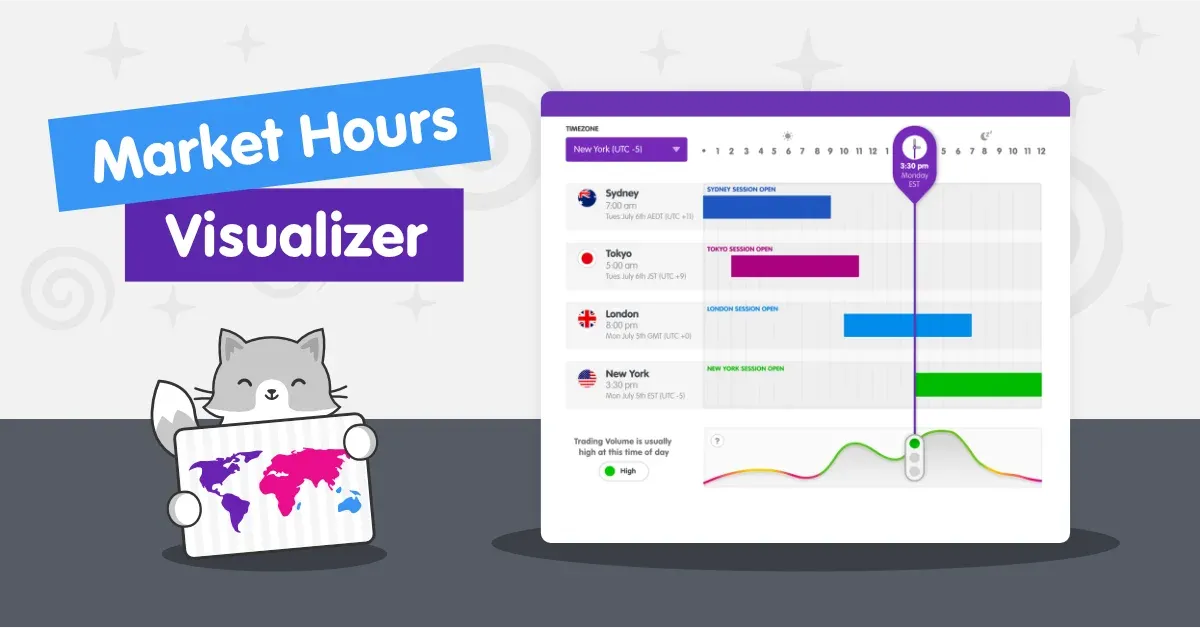

The Forex market operates 24 hours a day, but not all hours are equally active. High trading activity often leads to more significant price movements and opportunities to back-test your strategies. These “overlap hours” occur when two major markets are open simultaneously.

- London-New York Overlap: 8:00 AM to 12:00 PM EST

- Tokyo-London Overlap: 3:00 AM to 4:00 AM EST

By practicing during these times, you can analyze how markets react under varying volumes and liquidity.

2. Economic News Announcements

Market volatility tends to surge during the release of major economic indicators like Non-Farm Payroll (NFP), Gross Domestic Product (GDP) data, or Federal Reserve statements. Trading on a demo account during these events can help you:

- Develop risk management strategies.

- Test your reaction to sharp price movements.

- Learn how macroeconomic factors influence the market.

3. Your Local Time Efficiency

With the Exness Demo account accessible globally, aligning your practice time with your personal schedule is critical. Morning hours or times when you’re mentally alert will yield better learning outcomes.

“Trading practice is not about guessing the market but developing skills under authentic conditions and timings,” explains Robert L. Daniels, a certified financial strategist and trainer.

How Holidays and Global Schedules Affect Demo Trading

Market holidays heavily influence both Forex and stock markets. While you may focus on Forex for its 24/5 availability, stock trading schedules are more restricted. Here’s how these variations interact with your demo practice:

| Market | Time Open (GMT) | Time Close (GMT) | Note |

|---|---|---|---|

| New York Stock Exchange (NYSE) | 2:30 PM | 9:00 PM | Closed on U.S. holidays like July 4th. |

| London Stock Exchange (LSE) | 8:00 AM | 4:30 PM | UK bank holidays affect activity levels. |

| Tokyo Stock Exchange | 12:00 AM | 6:00 AM | Japanese holidays influence liquidity. |

Before scheduling your demo practice, review the trading calendar for holidays or reduced liquidity periods to avoid misinterpreting market behavior.

Optimize trading time with Exness demo: London, New York overlap

Optimize trading time with Exness demo: London, New York overlap

Key Advantages of Practicing on the Exness Demo Account During Optimal Hours

High Liquidity and Realistic Market Conditions

Practicing when volumes are high ensures that your strategies mimic real trading conditions. This is especially true for pairs like EUR/USD or GBP/USD, which dominate during the London and New York sessions.

Better Understanding Volatility

Volatility is a friend when recognized and managed well. Demo trading during economic events exposes you to sudden price spikes, preparing you for live market reactions.

Perfecting Risk Management

Risk management tools like stop-loss and take-profit orders become more effective when tested in dynamic environments. Experiment during high-volume hours to understand slippage, spreads, and price fluctuations.

Building Confidence for Transition to Live Trading

Regular practice during peak trading hours bridges the gap between a demo account and live trading. To take it further, explore insights from the article When to Go Live from Demo Account, which provides guidance on transitioning smoothly.

Tips to Maximize Learning with the Exness Demo Account

- Mimic Real-Life Scenarios: Simulation is only as effective as its resemblance to reality. Set the same stop-loss and trade sizes as you would in a live account.

- Track Your Progress: Treat your demo account like a growth tracker. Note when you trade, analyze results, and calculate how time-of-day impacts success.

- Diversify Time Periods: Despite the benefits of high liquidity hours, experiment with late-night or early morning trades, especially for low-liquidity pair behaviors.

“Understanding time zones is an underrated skill in trading. The more you diversify your practice hours, the better you harness trading patterns,” says Sarah Jacobs, an experienced forex analyst.

Conclusion

Timing is everything in trading. By knowing when to practice on your Exness Demo account, you can develop strategies backed by real-world data while improving market familiarity. Remember, the goal is not just to trade but to trade smartly—and practicing with the right schedule prepares you for profitable live trading experiences.

Want to know how leverage optimization plays into your schedule? Check out When to Apply Exness Leverage to take your trading strategies to the next level!

FAQ on “When to Practice with Exness Demo”

1. Why is the timing important when practicing with a demo account?

Practicing at the right time exposes you to realistic market conditions, including liquidity and volatility levels, helping you prepare better for live trading.

2. Can I practice during weekends on an Exness Demo account?

While Forex markets are closed during weekends, you can use the demo account to back-test strategies and analyze past price data.

3. What time zone should I consider for trading with Exness Demo?

Align your trading hours with market active periods, such as the London and New York overlaps. Adjust to your local schedule for convenience.

4. Do demo accounts reflect real-time market conditions?

Yes, Exness Demo accounts replicate real-time spreads, price movements, and market variables to ensure authentic learning experiences.

5. How soon should I shift to live trading from demo?

Transition when consistent profitability is achieved on the demo account, and you’ve mastered conditions at various trading times.

Implementing these practices into your demo approach equips you with a strong foundation for live trading success.